Generative Artificial Intelligence has been the buzzword on everyone’s lips, promising to revolutionize everything from risk assessment to customer service.

But how do you capitalize on all that AI has to offer while navigating challenges like data security and compliance? And how can you integrate your proprietary data to create a solution unique to you and your clients?

The answer, as you’ll guess by the name of this article, is RAG—Retrieval Augmented Generation.

This article explores how RAG can transform your proprietary data into a powerful asset, enhancing decision-making, streamlining compliance, and elevating customer engagement.

Want to implement RAG right away?

Check out our RAG Accelerator here to learn how we can help.

RAG (Retrieval Augmented Generation): A Brief Definition

Retrieval Augmented Generation (RAG) is an advanced AI methodology that combines the capabilities of retrieval-based models with generative models.

Here’s what those two components do:

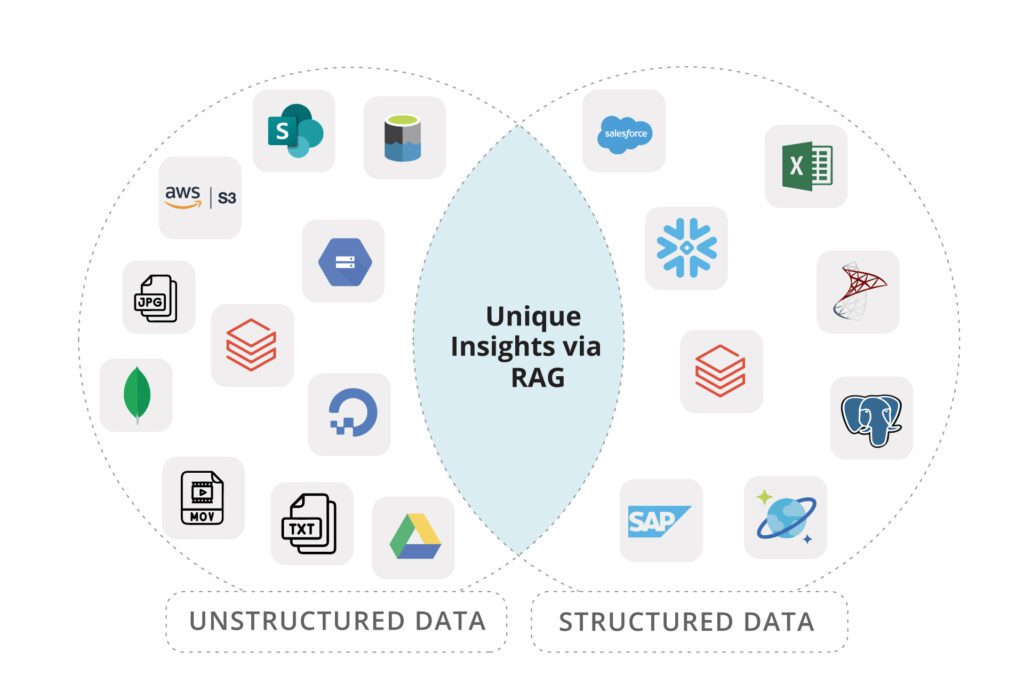

- Retrieval Component: This part of the model searches through a large corpus of data (such as databases, documents, or proprietary datasets) to find the most relevant information based on a given query or prompt. It dynamically retrieves the structured and unstructured data needed to inform the response, ensuring that it is context-specific and up-to-date.

- Generation Component: Once the relevant data is retrieved, the generative model (typically an LLM—large language model) uses this information to create a coherent and context-aware output. This could be a detailed report, an answer to a complex question, or a personalized recommendation.

And the process looks a little something like this:

In financial services, RAG can be used to extract and synthesize relevant information from:

- extensive financial databases

- transaction records

- market data

- regulatory documents

Think of it like an AI financial advisor that understands complex queries and can instantly sift through millions of financial records, market reports, and regulatory guidelines to provide accurate, context-aware answers.

How RAG Differs from Other AI Approaches

We like to think of RAG as an add-on to generative AI, especially LLMs. It enhances rather than replaces. Here’s how a RAG enhanced LLM differs from a purely generative model.

RAG vs Pure Generative Models: These traditional large language models generate outputs based on patterns learned from training data. While they can produce coherent responses, they might not always be accurate or relevant, especially in a dynamic field like finance, where market conditions and regulations are constantly changing.

The biggest difference is RAG’s ability to use your proprietary data.

You can use proprietary data in RAG for:

- Personalization: Deliver tailored insights and financial advice specific to individual clients or customer segments.

- Competitive Advantage: Differentiate your services by providing unique, data-driven insights that competitors without access to your proprietary data cannot replicate.

- Data Security: Keep sensitive financial data within your organization’s control while still utilizing it for AI-driven insights.

- Continuous Improvement: As you gather more data, the RAG system continuously refines its outputs, improving its accuracy and relevance over time.

| Feature | RAG-Enhanced LLMs | Pure Generative AI Models |

|---|---|---|

|

Data Utilization

|

|

|

|

Accuracy and Relevance

|

|

|

|

Customization and Personalization

|

|

|

|

Data Security and Compliance

|

|

|

Why The Financial Sector Needs RAG

Money and what we do with it can make or break businesses, personal fortunes, the stability of economies, and the nations that rely on them.

With so much at stake, financial services companies have an obligation to be accurate, compliant, and ethical.

RAG is uniquely positioned to help finance leaders achieve those outcomes. While traditional AI hallucinates information and can become outdated on proper protocols for compliance, RAG stays up-to-date and has accurate answers.

Did you know?

HatchWorks AI offers a RAG Accelerator, where you can get the advantages of RAG without putting in the time and effort to implement it yourself. And we take data security seriously.

Secure and Certified with SOC 2 Type I and HIPAA

At HatchWorks, trust and compliance are paramount. We adhere to the highest security standards, evidenced by our SOC 2 Type I and HIPAA certifications.

These certifications, verified through independent audits, ensure our systems are secure and your data is protected under strict privacy regulations. Stay informed with our real-time TrustCloud compliance program.

Benefits of RAG in the Financial Services Industry

Let’s look at a few ways RAG can benefit your work in the financial services sector.

Leveraging Proprietary Data for Competitive Edge

Your proprietary data—such as client transaction histories, market research, and internal financial models—represents a unique asset that competitors can’t access or replicate.

By integrating this exclusive data with external sources, RAG generates personalized, value-driven insights tailored to your organization.

For instance, a bank could use RAG to analyze proprietary customer data alongside public market trends, enabling it to identify unique investment opportunities or create bespoke financial products that competitors cannot match.

Here are some of the reasons you would want to combine your proprietary data with RAG:

- Personalized Insights: By combining proprietary client data with market information, RAG can generate highly tailored investment strategies or risk profiles.

- Exclusive Market Analysis: RAG can process internal trading data alongside public market information, potentially identifying trends or opportunities that competitors might miss.

- Product Innovation: Utilizing historical product performance data and client behavior patterns, RAG can assist in developing new financial products that better meet market demands.

Enhanced Decision-Making and Risk Management

RAG improves forecasting, risk assessment, and fraud detection by dynamically retrieving the most relevant data to support decisions. Let’s take a closer look:

- Improved Forecasting: By analyzing vast amounts of historical and real-time data, RAG can produce more accurate market predictions and economic forecasts.

- Comprehensive Risk Assessment: RAG can evaluate multiple risk factors simultaneously, providing a more holistic view of potential threats to investments or operations.

- Fraud Detection: RAG excels at identifying subtle patterns indicative of fraudulent activity.

💭 Imagine this: A large bank using RAG to analyze millions of daily transactions.

One day, the system notices a slight increase in the frequency of small, round-number transactions from accounts in a specific geographic area.

While this pattern might be too subtle for human analysts to spot immediately, RAG flags it as potentially suspicious.

Upon investigation, the bank uncovers a sophisticated money laundering operation, demonstrating RAG’s ability to detect nuanced patterns in vast datasets.

Regulatory Compliance and Data Governance

The finance sector is heavily regulated. You can’t afford non-compliance and neither can your customers and clients.

RAG assists financial institutions by pulling in the latest regulatory updates and ensuring all outputs align with current laws and standards.

This proactive approach reduces the risk of non-compliance, minimizes penalties, and strengthens the organization’s reputation for transparency and adherence to legal requirements.

This can look like:

- Real-time Regulatory Updates: RAG can continuously scan and incorporate the latest regulatory changes, ensuring all advice and operations remain compliant.

- Audit Trails: By recording the data sources and reasoning behind each decision, RAG provides transparent audit trails for regulators.

- Data Privacy: RAG can be programmed to adhere to data protection regulations like GDPR or CCPA, ensuring sensitive information is handled appropriately.

Customer Engagement and Personalization

RAG enhances customer engagement by delivering tailored financial advice, personalized product recommendations, and superior customer service:

- Tailored Financial Advice: By analyzing a customer’s financial history, goals, and risk tolerance, RAG can provide highly personalized financial planning advice.

Smart Product - Recommendations: RAG can suggest financial products that best suit a customer’s unique situation, improving cross-selling and customer satisfaction.

- Enhanced Customer Service: RAG-powered chatbots or virtual assistants can provide instant, accurate responses to customer queries, handling complex financial questions with ease.

This level of personalization will build trust, increase customer satisfaction, and foster long-term client relationships. And that all equates to money in the bank.

Overcoming Challenges of RAG for Financial Services

RAG, as beneficial as it is, does come with a few challenges. The good news is they’re easy to avoid. Here are three challenges and strategies to overcome them:

Challenge 1: Keeping Proprietary Data Safe and Secure

We’ve stated already that RAG is a better way to protect your data when using AI. But this is only true if you implement it correctly.

The challenge for financial services directly is that they handle highly sensitive data, and data privacy is at stake, especially in cross-border transactions where different jurisdictions have varying data protection regulations (e.g., GDPR in the EU vs. CCPA in California).

Managing data privacy when sharing information across borders can lead to compliance risks and potential breaches.

How to Overcome It: Organizations can overcome this challenge by deploying RAG models within secure, compliant environments—such as private cloud infrastructures or on-premises data centers.

Implementing robust data security measures using encryption, strict access controls, and anonymization techniques can protect sensitive information.

On top of those, adopting federated learning techniques, where data remains decentralized while models are trained locally, can help comply with cross-border data regulations without compromising privacy.

Did you know?

At HatchWorks AI we build access control into our RAG Accelerator. It’s absolutely essential for keeping your data safe and in the hands of only those who should have it.

You can learn more about that here.

Challenge 2: Integrating RAG Into Existing Systems

Integrating RAG models into your existing IT infrastructures can be complex, particularly when dealing with legacy systems.

This can lead to data silos, inefficient workflows, and a lack of interoperability. And it quickly becomes a logistical nightmare, directly countering the efficiency gains AI is meant to bring in the first place.

How to Overcome It: There are two options here. One is to start with a pilot project where you can identify integration pain points. The other is to work with a company like HatchWorks AI who can integrate it for you.

We offer a RAG Accelerator.

📚You may also like to read our guide: Embrace Generative AI in 2024: A Detailed Guide for Seamless Team Integration

Challenge 3: Keeping Data Clean and High-Quality

For RAG to provide meaningful outputs, the data it retrieves must be accurate, up-to-date, and relevant.

Problem is, companies often have incomplete records, data duplication, and outdated information.

How to Overcome It: Make sure you implement or already have a robust data governance framework. You should also have regular data cleaning, validation, and enrichment processes to keep data clean and up-to-date.

How RAG Can Be Used in Financial Institutions: Key Applications & Use Cases

The capabilities of RAG are clear as are its benefits. But how can it practically be used?

Here are 5 use cases to inspire you. Some of these will overlap the benefits we’ve already listed but will dig deeper.

Portfolio Management and Investment Strategy

Imagine if RAG could make portfolio management easier by providing real-time market analysis, trend prediction, and personalized investment recommendations. Well, it can.

For example, a hedge fund could use RAG to retrieve the latest market data, financial news articles, and economic indicators from multiple sources—all at once.

When a significant event occurs, such as a sudden change in interest rates, the RAG system can quickly assess its impact on various asset classes and individual securities.

Fraud Detection and Prevention

RAG can take real-time transaction data from multiple internal and external sources and use it to detect unusual patterns or behaviors faster than traditional methods.

For example, a bank could use RAG to monitor cross-border transactions, identifying inconsistencies or anomalies in real-time—such as an unusual transaction amount or a sudden change in location patterns.

By cross-referencing this data with historical transaction records and external databases, RAG helps detect potential fraud more quickly, minimizing risk and reducing financial losses.

Credit Scoring and Risk Assessment

RAG enhances credit scoring models by integrating an organization’s proprietary data (like customer transaction histories) with external financial data (such as credit bureau reports and macroeconomic indicators).

For example, a fintech company could use RAG to dynamically pull data from diverse sources, creating a more accurate, real-time picture of a customer’s creditworthiness.

This capability enables more precise credit risk assessments, allowing the company to extend credit responsibly while expanding its customer base to include underrepresented or underserved segments.

Regulatory Compliance and Reporting

RAG can automate and optimize compliance processes by ensuring continuous access to the latest regulatory updates, guidelines, and data.

For example, a global bank could use RAG to stay current with local and international regulatory changes by dynamically retrieving updates from financial authorities, integrating this information into its compliance monitoring systems, and automatically generating compliance reports.

This reduces the risk of non-compliance, saves time on manual research, and enhances transparency with regulators.

Customer Service and Advisory

If you have any customer-facing services, RAG can improve customer engagement by providing personalized, data-driven responses through chatbots and virtual advisors.

A great example is Morgan Stanley’s use of an OpenAI-powered assistant to support its wealth advisors.

The assistant, powered by RAG, retrieves up-to-date information from the firm’s extensive research databases and proprietary data to deliver precise, personalized insights to clients.

This ensures that advisors provide high-quality, tailored advice, improving client satisfaction and strengthening customer relationships with financial professionals.

What Will Your RAG Use-Case Be?

Customer service, compliance, risk assessment, fraud prevention, data retrieval, portfolio management… RAG can transform many aspects of your business.

Start by identifying where accurate, timely information makes the most impact.

Do you struggle to keep up with responding to client queries because your agents have to locate the correct information first?

Are compliance requirements changing so quickly that you’re worried your processes can’t keep up?

These are the types of considerations you need to make. Once you’ve identified your top use case, reach out to HatchWorks AI to implement RAG seamlessly.

Introducing the RAG Accelerator: HatchWorks AI’s Solution to Your RAG Needs

Implementing RAG can be daunting. It’s complex, time-consuming, and resource-intensive—especially if you’ve never done it before. Plus, you may not have the time or the team to get it done on your own.

That’s where the RAG Accelerator can help. Our service provides:

- Customized RAG solutions tailored to your unique data and business goals.

- Seamless integration with your existing systems and workflows.

- Continuous support and updates to keep your RAG implementation optimized.

- Top-tier data security and full compliance with privacy regulations.

Visit our service page or contact us today to learn how we can help you harness the full potential of RAG for your organization.

Turn Your Data Into a Differentiator

Access the power of AI in your enterprise with our RAG Accelerator.